By alphacardprocess October 16, 2025

Charging automated late fees on your rent collection procedure can be a smart way to keep things consistent and improve cash flow. Instead of manual reminders or follow-ups, automated systems charge late fees automatically when the payment is due late. It treats all tenants in the same manner as dictated by the lease document.

Is Charging Late Fees on Rent Legal?

Yes, in the majority of the United States, landlords are allowed to charge late fees for rent. However the regulations and thresholds do differ state by state. Late fees are typically enforceable as long as they’re reasonable and prominently disclosed in the lease agreement. Always review your state laws prior to implementing a late charge policy to remain compliant and to prevent legal conflicts.

How Grace Periods Work

A grace period is the extra time after the rent deadline during which a tenant has to pay without facing a late charge. It gives renters some flexibility in case of delays or forgetfulness. Grace periods usually range from zero to 30 days, and five days are common in most places.

Landlords may only charge a late fee after it has expired. A case in point is if rent is payable on the 1st and there’s a five-day grace, a late charge could only be imposed from the 6th. This is transparent expectation-making and eliminates dispute or confusion.

Forms of Late Rent Charges and How to Calculate

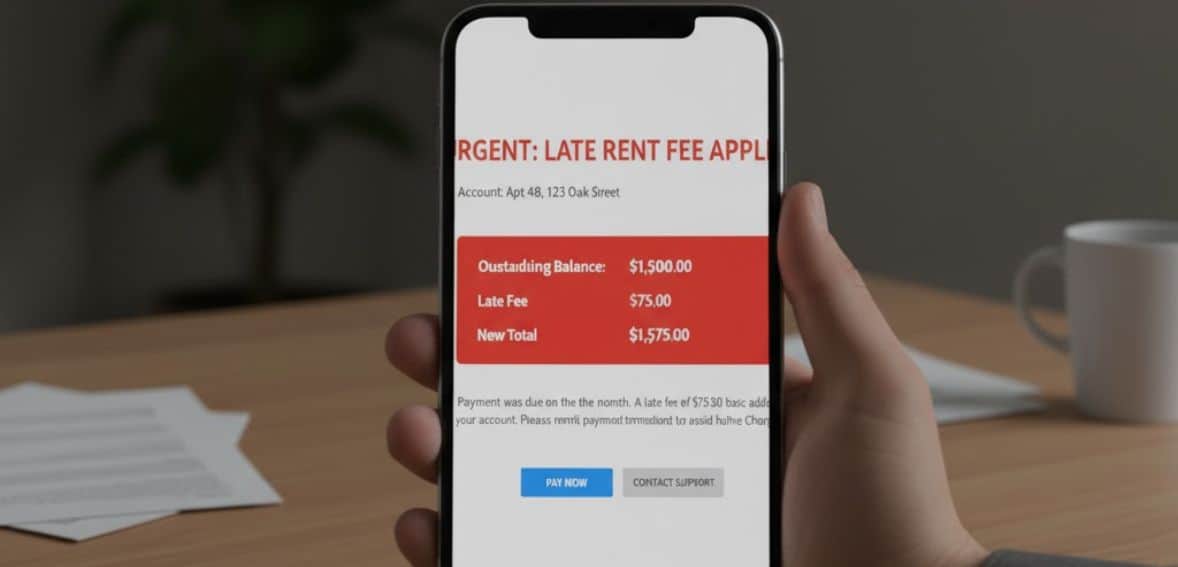

Landlords can charge late fees in many different ways, as long as they are within state law. It is advisable in most states to charge 5% if rent is overdue by a few days and 10% for longer delays. Flat charges are a fixed dollar amount, e.g., $75 on a $1,500 rent, with the total being $1,575 if paid after a 5-day grace period.

Percentage charges are on the rent, e.g., a 5% fee of $1,000 rent, which is $50. For example, a $50 initial late charge plus a $3 per day penalty for 10 days would equal $80. Courts consider charges of more than 10% of the monthly rent to be unreasonable, so keeping within reasonable limits makes the policy compliant, clear, and enforceable.

State-by-State Overview of Rent Late Fee Limits and Grace Periods

Common Challenges In Manual Rent Collection

Before switching to automation, it is important to understand why manual rent collection can be stressful and inefficient. Traditional methods like collecting cash, checks, or bank transfers may seem simple, but they often create unnecessary work and confusion for both landlords and tenants. Manually collecting rents takes a lot of time and effort. Landlords must call or send a text message to tenants, track payments, deposit checks, and manually update records.

Secondly, missed or late payments are also common when rent collection is not automated. Tenants simply forget due dates or delay payments because they have to physically drop off or mail the rent. This results in unpredictable cash flow and extra work for landlords who have to chase down payments.

Human errors are another big issue, when payments are processed manually mistakes like misplaced checks, wrong postings, or missed updates can happen often. These small errors can cause bigger problems, such as confusion over who has paid and disputes over balances. Manual systems also hinder the ability to maintain transparent records. Without tracking, it is difficult to show a history of payments or produce accurate reports at tax time.

Lastly, manual rent collection puts the property manager and tenants at odds. Constant reminders and follow-up calls about payment become uncomfortable and frustrating. Automated payment processing keeps rent collection professional, consistent, and less stressful for everyone involved.

When to Implement Automated Late Fees in Your Rent Collection System

Charging late fees automatically will make rent collection efficient and fair for landlords and renters. Late fees is something most property owners do not charge because it becomes too personal or awkward, especially when the renters have good reasons for being late.

But then, being overly accommodating creates long-term problems, like missing payments and unfairness between the renters. Once an automated system is in place, charges are automatically levied when rent is not paid by the due date, under the same rules for everybody. This ensures fairness and responsibility without unpleasant discussions of late rent payments.

Implement automatic late fees subsequently, after your rent collection system is set up and your tenants are comfortable with electronic payment. Make sure to clearly announce the new policy, describe the process, and send out reminders before it kicks in. Automatic late fees are time-saving, professional, and creates a systematic procedure to encourage timely payments without the inconvenience of manual reminders.

Setting Up Automatic Late Fees: Simple Step-by-Step Guide

Setting up automatic late fees simplifies the hassle of pursuing late payments every month. While the exact steps may vary depending on the rental management platform you use, the overall process is quite similar. Here’s a simple way to set it up:

Step 1: Log In to Your Account

Start by logging into your rental billing or property management account. Go to the payments or rent options section where you manage tenant invoices and billing.

Step 2: Choose the Tenant or Lease

Choose the tenant or specific lease on which you want to add the late fee. Most programs enable you to make one-off edits to settings per tenant so that you have control over managing your properties.

Step 3: Turn On Late Fees

Locate the option for turning on or enabling late fees. Once you turn it on, you can enter the amount and select how the fee will be charged—either as a one time flat fee or as a percentage of late rent owed.

Step 4: Choose the Trigger Date

Select when the late fee should be charged. For instance, you can select it after a three or five-day grace period after the due date of rent. You may also determine whether to raise the fee each day until payment for the balance is made.

Step 5: Review and Save Changes

Double-check all the information, including the fee amount, rate, and when it is applied. Save your settings so the system automatically charges late fees and updates rent invoices in case of late payment.

Once enabled, the system will automatically charge late fees, send reminders to tenants, and will update balances automatically. This way, rent collection is consistent, and you use less time and effort on manual reminders.

Configuring Late Fee Policies

Most rental systems allow for the simple setup of late fee rules to suit the specific needs of your property. You can set individual tenant or specific lease settings, or assign a common rule to all your properties. The most typical options are flat fees, where a fixed sum is added on after the due date. There are also percentage fees, where the outstanding rent is calculated as a percentage. Let’s not forget daily fees, where fees build up each day the payment is late.

Alternatively, you can have a grace period to give tenants an additional few days before a charge is made. Customizing these regulations maintains fairness and transparency without crossing legal lines. Be sure to review your local rental codes to keep your late fee policy up to code and fair to your tenants.

Streamline Rent Collection and Encourage On-Time Payments

Good rent collection is perhaps the most important part of being a landlord. It ensures steady cash flow and helps to create a good tenant relationship. The trick is to start with a transparent lease contract that outlines when the rent should be paid, what payment methods are accepted, and what late-payment penalties will be charged. Being upfront about these terms reduces misunderstandings and establishes the correct expectations.

Secondly, offering payment alternatives also goes a long way—whether online transfers, automatic deductions, gives tenants the leeway to pay on time. Streamlining payments by encouraging automatic payments can reduce delays even more, as the tenants will not be required to remember due dates each month. Gentle reminders to make payments, through email or SMS, serve as a good reminder to busy tenants and ensure each deadlines are met accurately.

It’s best to charge late fees consistently while being fair and within legal limits. If tenants are experiencing financial hardship, a brief grace period or an official payment plan can preserve goodwill and avoid unnecessary disputes. Property management software can also simplify the entire process by automating payments, tracking rent history, and facilitating communication.

But if a tenant is continuously failing to pay rent despite all attempts, landlords should be prepared to implement local laws and go to court as a last resort. With the incorporation of simple to understand principles, flexible systems, and modern tools, landlords can simplify rent collection and reduce the stress of delayed payments.

Key Features to Look for in Automated Rent Collection Tools

Choosing the right property rent collection platform can be overwhelming, but the secret is to focus on the features that make it easier and more efficient. The best platforms save time, reduce errors, and streamline the landlord-tenant experience. Firstly tenants must be able to easily automate monthly payments. This allows for on-time payment of rent and maintains cash flow on a consistent basis.

Notifications and reminders to the tenant are important as well. Automated reminders of upcoming due dates, payment success, or payment failure keep everyone informed and on schedule without having to repeatedly follow up. Integration with accounting programs is also a necessity. Paying rent in sync with software like QuickBooks or other property management software saves the trouble of duplication of work, reduces errors, and makes it simpler to manage finances.

Having a mobile app can be a blessing as rent can be paid on time, payment history can be checked, and reminders can be received on mobile phones, which is convenient and raises satisfaction levels. Let’s not forget secure payment processing also matters. Make sure tools possess bank-grade encryption and PCI compliance to protect sensitive financial information, both for tenants and landlords.

Finally, some software offers tenant credit reporting. Reporting timely payments to credit bureaus encourages prompt rent payments and strengthens tenants’ credit profiles. Prioritizing these features helps property managers to simplify rent collection, reduce stress, and create a less stressful experience for their residents.

Top Rent Collection Apps

AppFolio

This platform streamlines all aspects of property management with time-saving tools for increased efficiency. You can easily receive rent online, making payment quicker and easier for both the landlord and the tenant. It also has tenant screening tools to assist you in finding trustworthy renters and handling leases from beginning to end with ease.

Requests for maintenance can be monitored and settled quickly, to ensure properties stay in excellent condition. Marketing your available units is easy with in-built websites and features that allow you to list multiple properties at once from shared information such as photos and descriptions.

For accounting, the platform has integrated accounting and process automation to manage daily tasks seamlessly. With iOS and Android mobile apps, you can have everything under your control from anywhere. Additionally, the program is scalable, so it can be an excellent choice for small portfolios while also being robust enough to manage more than 500 properties under a single account.

Rentvine

Rentvine offers an integrated platform that brings together accounting, leasing, maintenance, and tenant communication into a single system. This built-in model eliminates manual effort and simplifies property management.

The software is scalable to suit any portfolio, from a few units to hundreds of properties, so your business is free to expand without limits. Rentvine links with other tools effortlessly, enabling worry-free automation and seamless data sharing between systems.

The platform is ever-evolving with refreshing features and the interface also provides management tools that are advanced, intuitive, and aligned with changing business needs. Besides that, Rentvine also has good customer care, allowing property managers to resolve problems effectively and have uninterrupted seamless daily operations

DoorLoop

DoorLoop makes it easy and safe to collect rents by processing rent and fee payments automatically, tracking overdue amounts, and connecting directly to your bank account. This allows for prompt payment to landlords while reducing administrative tasks.

Tenants enjoy the ease of acceptance of various forms of payment, including credit cards, debit cards, ACH, cash, or checks, enabling easier on-time payment and fewer late payments. Automatic reminders before the rent is due are also sent by the platform, ensuring steady cash flow without manual reminders.

DoorLoop is simple to set up and navigate, offering an intuitive experience for property managers without a complicated learning curve. As your portfolio grows, the software scales with your business, providing all the tools needed to manage more properties efficiently while keeping operations smooth and stress-free.

Avail

With this platform, managing your property is easy and hassle-free. You can receive rent online with secure payment processing and full payment tracking. Screening tenants is easy with customizable applications and comprehensive background checks, which aid you in finding reliable tenants.

You can generate and sign leases online using state-specific, attorney-approved templates and e-signatures. Listings can be placed across several rental platforms simultaneously, saving time and attracting tenants quickly.

The platform also allows you to handle maintenance requests with photos, monitor income and expenditures to assist with tax preparation, and converse directly with renters. You can even build property websites and report rents to credit bureaus so tenants can establish credit, all from a single dashboard.

Conclusion

Automating late fees simplifies the collection of rent, making it more equitable, efficient, and reliable for landlords and tenants. It eliminates the stress of tracking manually and ensures payments are processed consistently. By setting strict policies and automating the implementation, you protect your business’s cash flow without compromising relations with tenants.

FAQs

What are automated late fees

Automated late charges are charges automatically levied by a rent collection system upon failure of renters to comply with their payment due dates.

Why are landlords utilizing automated late charges?

They are time-efficient, consistent, and prevent awkward interactions regarding overdue or missed rent payments.

Can renters protest automated late charges?

Yes, tenants can appeal them if they believe there was an error, such as a computer glitch or a reasonable payment delay.

Do automated late charges comply with local regulations?

Yes, the majority of systems provide landlords with the ability to impose limits and grace periods based on state and local regulations.

What is the impact on tenant relations with automated late charges?

They provide more openness and professionalism in rent collection, decreasing emotional battles and maintaining communication objectives.